How To Get WIC If Income Too High: Comprehensive Guide

For many families, the Women, Infants, and Children (WIC) program is a lifeline that provides essential nutritional support. However, if your income exceeds the standard eligibility criteria, it may seem like you're out of options. But don't worry! There are strategies and exceptions that can help you qualify for WIC even if your income is higher than the typical limits. This article will guide you through the process step by step.

WIC is a federal assistance program designed to provide food, nutrition education, breastfeeding support, and healthcare referrals to low-income pregnant, breastfeeding, and postpartum women, infants, and children up to age five. While income guidelines play a significant role in eligibility, there are ways to navigate the system and maximize your chances of qualifying.

In this article, we'll explore how you can still access WIC benefits even if your income is higher than the standard threshold. We'll cover everything from understanding income guidelines to identifying exceptions and special circumstances that could make you eligible. Let's dive in!

Read also:Free Remoteiot Platform Raspberry Pi The Ultimate Guide For Iot Enthusiasts

Table of Contents:

- Understanding WIC Income Guidelines

- Income Exceptions and Special Circumstances

- Documenting Your Income

- State-Specific Rules and Regulations

- How to Apply for WIC

- Tips for Maximizing Eligibility

- Frequently Asked Questions

- Useful Resources and References

- Conclusion and Call to Action

Understanding WIC Income Guidelines

What Are WIC Income Guidelines?

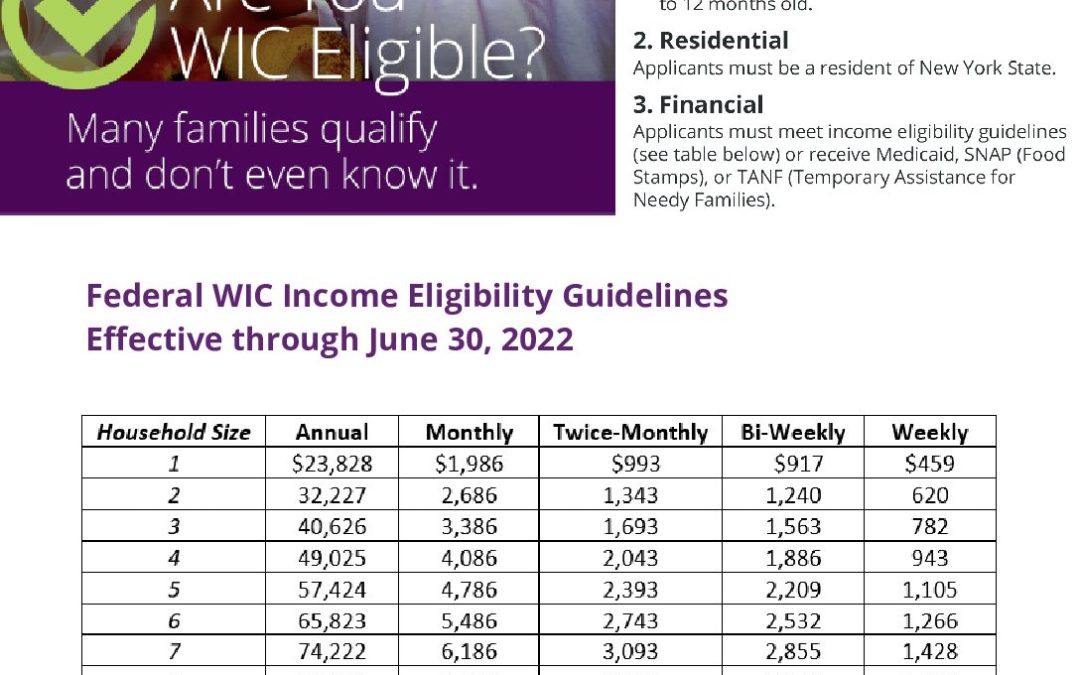

WIC income guidelines are set by the federal government but may vary slightly depending on the state you reside in. Generally, your household income must fall at or below 185% of the Federal Poverty Level (FPL) to qualify for WIC benefits. However, there are exceptions and special circumstances that can allow you to qualify even if your income exceeds these limits.

For instance, if you have a larger household size, the income threshold increases proportionally. This means that a family of four earning slightly above the standard limit may still qualify due to the adjusted income guidelines for larger households.

How Are Income Guidelines Calculated?

To determine whether you qualify based on income, WIC agencies calculate your household income as a percentage of the FPL. This includes all sources of income, such as wages, Social Security benefits, unemployment compensation, and other forms of financial assistance. It's important to note that some states offer more flexibility in how they calculate income, which could work in your favor.

Key Points:

- WIC income guidelines are based on the Federal Poverty Level (FPL).

- Household size affects the income threshold.

- Some states have more lenient income calculations.

Income Exceptions and Special Circumstances

Special Circumstances That May Qualify You

Even if your income exceeds the standard WIC guidelines, there are several special circumstances that could make you eligible for benefits. These include:

Read also:Securely Connect Remote Iot Vpc Raspberry Pi Download Windows Free

- Pregnancy: Pregnant women are often given priority in WIC eligibility, even if their income is slightly higher than the limit.

- Breastfeeding Mothers: Women who are breastfeeding may qualify for WIC benefits regardless of income, as the program places a strong emphasis on supporting breastfeeding.

- Children with Special Needs: If you have children with nutritional deficiencies or special dietary needs, you may qualify for WIC benefits regardless of income.

- Participation in Other Assistance Programs: Families receiving benefits from programs like SNAP, TANF, or Medicaid may automatically qualify for WIC, even if their income is higher than the standard limit.

Temporary Financial Hardship

If your household has experienced a recent financial hardship, such as job loss, medical expenses, or unexpected expenses, you may still qualify for WIC benefits. WIC agencies often take into account temporary changes in income when determining eligibility. Be sure to provide documentation of these changes when applying.

Documenting Your Income

What Documents Do You Need?

When applying for WIC, you'll need to provide documentation of your household income. Acceptable forms of documentation include:

- Pay stubs from the past 30 days

- Income tax returns

- Unemployment benefit statements

- Letters from employers or benefit providers

- Bank statements

It's crucial to gather all necessary documents before your appointment to ensure a smooth application process. If you're unsure about what to bring, contact your local WIC office for guidance.

How to Present Your Income Information

When presenting your income information, be thorough and transparent. Clearly outline all sources of income, including any recent changes or reductions. If you've experienced a temporary financial hardship, provide detailed documentation to support your claim. This will increase your chances of qualifying for WIC benefits.

State-Specific Rules and Regulations

How State Rules Affect WIC Eligibility

While WIC is a federal program, each state has the authority to set its own rules and regulations regarding eligibility. Some states have more lenient income guidelines, while others may offer additional benefits or exceptions. It's important to familiarize yourself with the specific rules in your state to maximize your chances of qualifying.

Example: In California, households earning up to 200% of the FPL may qualify for WIC benefits, while in Texas, the limit is slightly lower at 185%. Always check with your local WIC office to understand the rules in your area.

State Resources and Support

Many states offer additional resources and support for families seeking WIC benefits. These may include:

- Online application portals

- Hotlines for assistance and guidance

- Community outreach programs

Take advantage of these resources to ensure you have all the information you need to apply successfully.

How to Apply for WIC

Steps to Apply for WIC

Applying for WIC is a straightforward process, but it requires some preparation. Follow these steps to ensure a successful application:

- Contact Your Local WIC Office: Find the nearest WIC office in your area and schedule an appointment.

- Gather Required Documents: Bring proof of income, residency, and identification for all household members applying for benefits.

- Attend Your Appointment: Meet with a WIC representative to discuss your eligibility and complete the application process.

- Receive Your Benefits: If approved, you'll receive WIC benefits in the form of electronic benefits transfer (EBT) cards or vouchers.

What Happens After You Apply?

Once you've submitted your application, the WIC office will review your information and determine your eligibility. If approved, you'll receive benefits for a specified period, usually six months to one year. You'll need to recertify your eligibility periodically to continue receiving benefits.

Tips for Maximizing Eligibility

Strategies to Increase Your Chances

Here are some tips to help you maximize your chances of qualifying for WIC benefits:

- Understand Income Guidelines: Familiarize yourself with the income guidelines in your state and calculate your household income accordingly.

- Document Special Circumstances: Provide detailed documentation of any special circumstances, such as pregnancy, breastfeeding, or financial hardship.

- Seek State-Specific Support: Reach out to your local WIC office for guidance and support throughout the application process.

Common Mistakes to Avoid

Avoid these common mistakes when applying for WIC:

- Not providing complete documentation

- Failing to disclose all sources of income

- Not contacting your local WIC office for clarification

Frequently Asked Questions

Can I Still Qualify for WIC If My Income Is Too High?

Yes, in certain circumstances, you may still qualify for WIC benefits even if your income exceeds the standard guidelines. Factors such as household size, pregnancy, breastfeeding, and special dietary needs can all influence your eligibility.

How Often Do I Need to Recertify My Eligibility?

WIC eligibility typically needs to be recertified every six months to one year, depending on your state's rules. Be sure to stay in contact with your local WIC office to ensure a seamless recertification process.

Useful Resources and References

For more information on WIC eligibility and application processes, consult the following resources:

Conclusion and Call to Action

In conclusion, while WIC income guidelines may seem restrictive, there are numerous ways to qualify for benefits even if your income exceeds the standard limits. By understanding the guidelines, documenting your income accurately, and taking advantage of special circumstances, you can increase your chances of accessing this vital nutritional support.

We encourage you to take action by contacting your local WIC office, gathering the necessary documentation, and applying for benefits. Share this article with others who may benefit from the information, and don't hesitate to leave a comment or question below. Together, we can ensure that all families have access to the nutrition they need to thrive.