Fintechzoom Com ETF Market Vanguard: A Comprehensive Guide To Navigating The World Of ETFs

ETFs have become a cornerstone of modern investing, offering investors a flexible, cost-effective way to diversify their portfolios. Platforms like Fintechzoom.com have emerged as powerful tools for accessing and analyzing ETF markets, with Vanguard being a leading player in the ETF space. If you're looking to deepen your understanding of ETFs and how they fit into your investment strategy, this article is your ultimate resource.

In today's rapidly evolving financial landscape, exchange-traded funds (ETFs) have revolutionized the way individuals and institutions invest. These innovative investment vehicles combine the benefits of mutual funds and individual stocks, providing investors with unparalleled flexibility and diversification. As one of the largest and most reputable ETF providers, Vanguard has set the standard for quality and affordability in the industry.

Through platforms like Fintechzoom.com, investors now have access to cutting-edge tools and resources to research, analyze, and trade ETFs more effectively than ever before. In this comprehensive guide, we'll explore the ETF market, examine Vanguard's offerings, and provide actionable insights to help you make informed investment decisions.

Read also:How To Remotely Access Raspberry Pi With Remoteiot Download For Windows

Table of Contents

- Introduction to ETF Market Vanguard

- What is an ETF?

- Vanguard ETF Overview

- Fintechzoom.com and Its Role in ETF Analysis

- Benefits of Investing in ETFs

- Choosing the Right ETF

- Risks Associated with ETFs

- Vanguard ETF Performance

- Tools for ETF Analysis

- Conclusion: Navigating the ETF Market with Confidence

Introduction to ETF Market Vanguard

Understanding the ETF Market

Exchange-traded funds (ETFs) have transformed the investment landscape, offering investors a flexible and cost-effective way to build diversified portfolios. The ETF market has grown exponentially over the past decade, with assets under management surpassing $7 trillion globally. Vanguard, one of the pioneers in the ETF space, has played a pivotal role in shaping this market through its innovative products and commitment to low-cost investing.

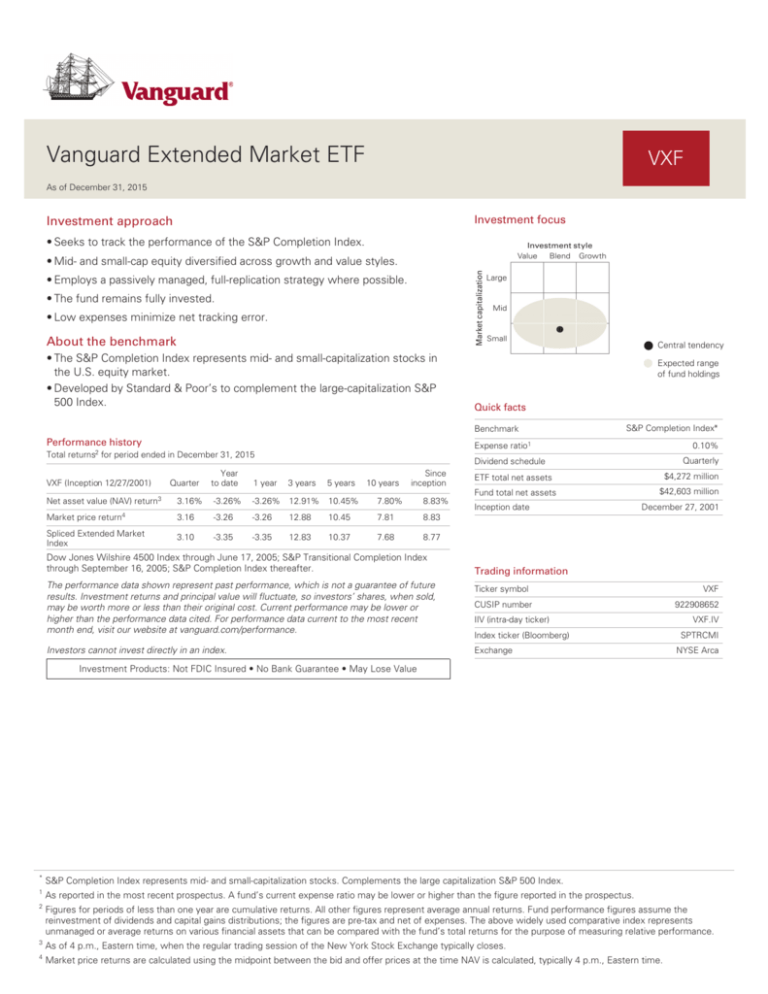

Vanguard ETFs are renowned for their low expense ratios, making them an attractive option for both retail and institutional investors. With a wide range of products spanning domestic and international markets, Vanguard offers something for every type of investor. Whether you're looking to invest in broad market indices, sector-specific funds, or fixed-income ETFs, Vanguard has a solution tailored to your needs.

What is an ETF?

Definition and Key Features

An ETF, or exchange-traded fund, is a type of investment fund that trades on stock exchanges much like individual stocks. ETFs typically track an index, sector, commodity, or other assets, allowing investors to gain exposure to a diversified portfolio with a single purchase. One of the key advantages of ETFs is their flexibility; investors can buy and sell them throughout the trading day at market-determined prices.

Some of the key features of ETFs include:

- Low cost: ETFs generally have lower expense ratios compared to traditional mutual funds.

- Flexibility: Investors can trade ETFs intraday, just like stocks.

- Diversification: ETFs offer exposure to a wide range of assets, reducing the risk associated with individual stock investing.

- Transparency: ETFs typically disclose their holdings daily, providing investors with greater visibility into their portfolios.

Vanguard ETF Overview

Why Vanguard is a Leading ETF Provider

Vanguard has established itself as a leader in the ETF industry, thanks to its commitment to low-cost investing and innovative product offerings. The company offers over 80 ETFs across a wide range of asset classes, including equities, fixed income, and international markets. Vanguard's ETFs are designed to provide investors with broad market exposure, low-cost diversification, and professional management.

Read also:Management Of Raspberry Pis Remotely With Remoteiot Management Platform

Some of Vanguard's most popular ETFs include:

- Vanguard Total Stock Market ETF (VTI)

- Vanguard FTSE Developed Markets ETF (VEA)

- Vanguard High Dividend Yield ETF (VYM)

Fintechzoom.com and Its Role in ETF Analysis

How Fintechzoom.com Enhances Your ETF Investment Journey

Fintechzoom.com is a powerful platform that provides investors with the tools and resources needed to analyze and trade ETFs effectively. The platform offers real-time market data, advanced charting tools, and comprehensive research reports to help investors make informed decisions. With Fintechzoom.com, you can easily compare ETFs, track performance, and stay up-to-date with the latest market trends.

Some of the key features of Fintechzoom.com include:

- Real-time market data and analysis

- Advanced charting tools for technical analysis

- Comprehensive research reports and insights

- User-friendly interface for easy navigation

Benefits of Investing in ETFs

Why ETFs Are a Smart Investment Choice

ETFs offer numerous benefits that make them an attractive investment option for a wide range of investors. From their low cost and flexibility to their diversification and transparency, ETFs provide a compelling value proposition in today's fast-paced financial markets. Below are some of the key benefits of investing in ETFs:

1. Cost-Effective: ETFs typically have lower expense ratios compared to traditional mutual funds, making them an affordable option for long-term investors.

2. Flexibility: ETFs can be bought and sold throughout the trading day, giving investors greater control over their investments.

3. Diversification: ETFs offer exposure to a wide range of assets, reducing the risk associated with individual stock investing.

4. Transparency: ETFs disclose their holdings daily, providing investors with greater visibility into their portfolios.

Choosing the Right ETF

Key Considerations for Selecting ETFs

Selecting the right ETF requires careful consideration of several factors, including your investment goals, risk tolerance, and time horizon. Below are some key considerations to keep in mind when choosing an ETF:

- Investment Objective: Determine whether you're looking for growth, income, or capital preservation.

- Risk Tolerance: Assess your comfort level with market volatility and choose ETFs that align with your risk appetite.

- Expense Ratio: Compare the expense ratios of different ETFs to ensure you're getting the best value for your investment.

- Liquidity: Consider the trading volume and bid-ask spread of the ETF to ensure it's easy to buy and sell when needed.

Risks Associated with ETFs

Understanding the Risks of ETF Investing

While ETFs offer numerous benefits, they are not without risks. It's important to understand these risks before investing in ETFs. Some of the key risks associated with ETFs include:

- Market Risk: ETFs are subject to market fluctuations, which can impact their value.

- Liquidity Risk: Some ETFs may have low trading volumes, making it difficult to buy or sell them at favorable prices.

- Tracking Error: ETFs may not perfectly track their underlying index, leading to discrepancies in performance.

- Concentration Risk: Sector-specific ETFs may be more vulnerable to market downturns in their respective industries.

Vanguard ETF Performance

Analyzing Vanguard ETF Returns

Vanguard ETFs have consistently delivered strong performance across a wide range of market conditions. The company's commitment to low-cost investing and professional management has resulted in robust returns for investors. Below are some key performance metrics for Vanguard ETFs:

- Vanguard Total Stock Market ETF (VTI): 10-year annualized return of 12.4%

- Vanguard FTSE Developed Markets ETF (VEA): 10-year annualized return of 9.8%

- Vanguard High Dividend Yield ETF (VYM): 10-year annualized return of 10.2%

Tools for ETF Analysis

Maximizing Your ETF Investment with Advanced Tools

Investors today have access to a wide range of tools and resources to analyze and trade ETFs effectively. Platforms like Fintechzoom.com offer cutting-edge features such as real-time market data, advanced charting tools, and comprehensive research reports. By leveraging these tools, investors can make more informed decisions and optimize their ETF portfolios.

Some of the key tools for ETF analysis include:

- Real-time market data feeds

- Advanced charting and technical analysis tools

- Research reports and analyst insights

- Portfolio tracking and performance analysis

Conclusion: Navigating the ETF Market with Confidence

In conclusion, ETFs have become an essential component of modern investing, offering investors a flexible, cost-effective way to build diversified portfolios. Platforms like Fintechzoom.com and providers like Vanguard have made it easier than ever to research, analyze, and trade ETFs effectively. By understanding the key features, benefits, and risks of ETFs, investors can make informed decisions and achieve their financial goals.

We invite you to share your thoughts and experiences with ETF investing in the comments section below. Additionally, feel free to explore our other articles for more insights into the world of finance and investing. Together, let's navigate the ETF market with confidence and achieve financial success.