Chase Mortgage Rates For Refinancing: A Comprehensive Guide To Smart Financial Decisions

Refinancing your mortgage can be a game-changer for your financial future, and understanding Chase mortgage rates for refinancing is a critical first step in making an informed decision. Whether you're aiming to lower your monthly payments, shorten the term of your loan, or tap into your home's equity, having the right information is key. In this article, we'll break down everything you need to know about Chase mortgage rates, the refinancing process, and how it can benefit you.

As one of the largest financial institutions in the United States, Chase offers a wide range of mortgage refinancing options tailored to meet the needs of homeowners. However, navigating the world of refinancing can be complex, especially when it comes to understanding interest rates, fees, and eligibility requirements. This guide aims to simplify the process and empower you with the knowledge to make the best financial decision for your situation.

Whether you're a first-time refinancer or a seasoned homeowner, this article will provide you with actionable insights into Chase mortgage rates, the benefits of refinancing, and how to maximize your savings. Let's dive in and explore the opportunities that refinancing with Chase can offer you.

Read also:Aagmal A Comprehensive Guide To The Rising Star In The Entertainment World

Table of Contents

- Understanding Mortgage Refinancing

- Chase Mortgage Rates for Refinancing

- Eligibility Requirements for Refinancing

- Benefits of Refinancing with Chase

- The Refinancing Process

- Costs Associated with Refinancing

- Current Market Trends in Mortgage Rates

- Comparison with Other Banks

- Tips for a Successful Refinancing Experience

- Frequently Asked Questions

Understanding Mortgage Refinancing

Mortgage refinancing involves replacing your existing home loan with a new one, often with more favorable terms. Homeowners typically refinance to secure a lower interest rate, reduce monthly payments, or shorten the loan term. Understanding the basics of refinancing is essential before diving into Chase mortgage rates for refinancing.

Why Refinancing Makes Sense

Refinancing your mortgage can provide numerous financial benefits, such as:

- Lowering your monthly mortgage payments

- Switching from an adjustable-rate mortgage (ARM) to a fixed-rate mortgage

- Tapping into your home's equity for other financial needs

Each of these benefits can contribute to a more stable financial future, making refinancing an attractive option for many homeowners.

Chase Mortgage Rates for Refinancing

Chase offers competitive mortgage rates for refinancing that can help you save money over the life of your loan. The rates vary based on factors such as your credit score, loan-to-value ratio (LTV), and the type of mortgage you choose.

Factors Influencing Chase Mortgage Rates

Several key factors affect the mortgage rates offered by Chase for refinancing:

- Credit Score: A higher credit score generally qualifies you for lower interest rates.

- Loan-to-Value Ratio (LTV): A lower LTV can result in better rates.

- Loan Type: Fixed-rate versus adjustable-rate mortgages come with different rate structures.

It's important to assess these factors carefully to determine the best refinancing option for your situation.

Read also:Mastering My Scratchboard A Comprehensive Guide To Unlock Your Creative Potential

Eligibility Requirements for Refinancing

Before applying for refinancing with Chase, it's crucial to understand the eligibility requirements. While Chase mortgage rates for refinancing are competitive, you must meet certain criteria to qualify:

- A stable income source

- A minimum credit score, typically 620 or higher

- Equity in your home, usually at least 20%

Meeting these requirements increases your chances of securing a favorable refinancing deal with Chase.

Benefits of Refinancing with Chase

Refinancing with Chase offers several advantages that make it an attractive option for homeowners:

Lower Monthly Payments

By securing a lower interest rate, you can significantly reduce your monthly mortgage payments, freeing up funds for other financial goals.

Improved Loan Terms

Chase allows you to switch from an adjustable-rate mortgage to a fixed-rate mortgage, providing stability and predictability in your monthly payments.

Access to Home Equity

Refinancing can help you tap into your home's equity, providing funds for home improvements, education, or other significant expenses.

The Refinancing Process

Understanding the refinancing process is essential to ensure a smooth and successful experience. Here's a step-by-step guide to refinancing with Chase:

Step 1: Evaluate Your Current Mortgage

Take stock of your current loan terms, including interest rate, monthly payments, and remaining balance. This will help you determine if refinancing is beneficial.

Step 2: Gather Financial Documents

Prepare all necessary financial documents, such as proof of income, tax returns, and bank statements, to streamline the application process.

Step 3: Apply for Refinancing

Submit your application through Chase's online portal or by visiting a local branch. A Chase representative will guide you through the process and provide information on available Chase mortgage rates for refinancing.

Costs Associated with Refinancing

While refinancing can save you money in the long run, it's important to be aware of the associated costs:

Closing Costs

Refinancing typically involves closing costs, which can range from 2% to 5% of the loan amount. These costs include appraisal fees, title insurance, and origination fees.

Prepayment Penalties

Some loans may have prepayment penalties if you pay them off early through refinancing. Be sure to check your current loan agreement for any such clauses.

Current Market Trends in Mortgage Rates

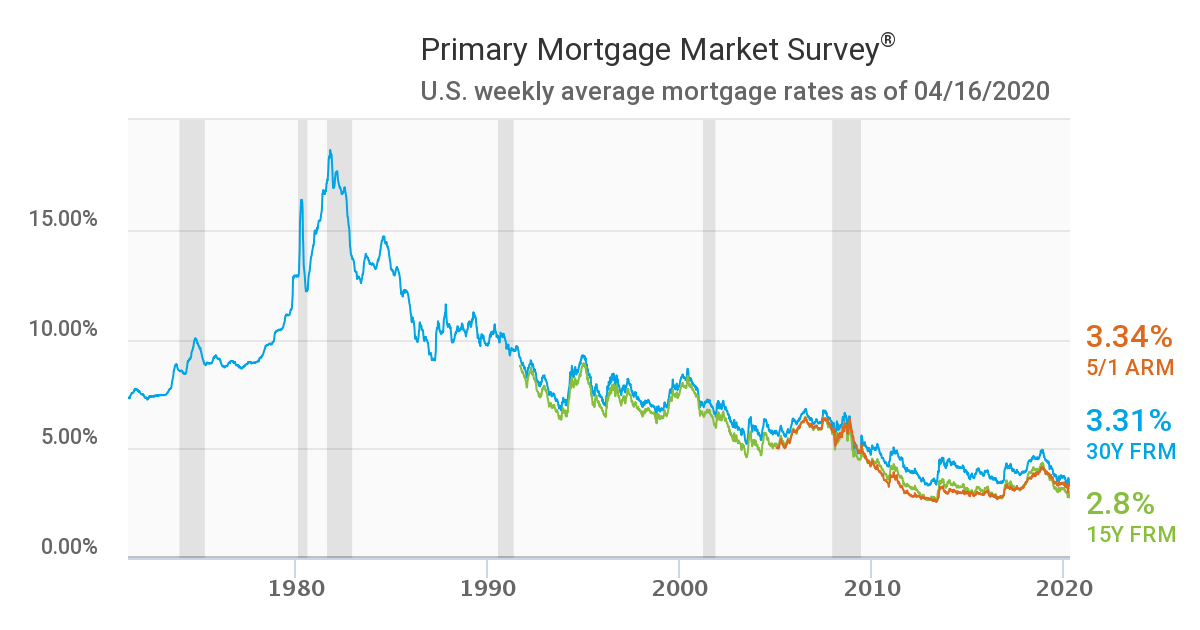

Staying informed about current market trends can help you time your refinancing decision effectively. As of the latest data, mortgage rates have been relatively low, making it an ideal time to consider refinancing. According to the Federal Reserve Bank of St. Louis, the average 30-year fixed mortgage rate has hovered around 6% in recent months.

Impact of Economic Factors

Economic conditions, such as inflation and Federal Reserve policies, can influence mortgage rates. Keeping an eye on these factors can help you make a well-timed refinancing decision.

Comparison with Other Banks

When considering Chase mortgage rates for refinancing, it's wise to compare them with those offered by other banks. While Chase is known for its competitive rates and customer service, other institutions may offer promotions or special deals that could be worth exploring.

Key Points to Compare

When comparing Chase with other banks, consider the following:

- Interest rates

- Closing costs

- Customer service and support

Doing your research will ensure you choose the best refinancing option for your needs.

Tips for a Successful Refinancing Experience

To make the most of your refinancing journey, follow these tips:

Shop Around for the Best Rates

Don't settle for the first rate you're offered. Take the time to compare rates from multiple lenders, including Chase, to ensure you're getting the best deal.

Improve Your Credit Score

A higher credit score can qualify you for lower interest rates. Pay down debt, make timely payments, and monitor your credit report to boost your score before applying.

Understand All Fees and Terms

Read the fine print and fully understand all fees and terms associated with your refinancing agreement. This will help you avoid unexpected costs down the road.

Frequently Asked Questions

What Are Chase Mortgage Rates for Refinancing?

Chase offers competitive mortgage rates for refinancing that vary based on factors such as credit score, loan-to-value ratio, and loan type. Rates are subject to change based on market conditions.

How Long Does the Refinancing Process Take?

The refinancing process typically takes 30 to 60 days, depending on the complexity of your loan and the speed of document processing.

Are There Any Prepayment Penalties with Chase?

Chase does not impose prepayment penalties on most of its mortgage products, allowing you to refinance without incurring additional fees.

Conclusion

Refinancing your mortgage with Chase can be a smart financial move, providing opportunities to lower your monthly payments, improve loan terms, and access home equity. By understanding Chase mortgage rates for refinancing and following the steps outlined in this guide, you can make an informed decision that benefits your financial future.

We encourage you to take action by exploring your refinancing options with Chase. Share your thoughts or questions in the comments below, and don't hesitate to reach out if you need further assistance. For more insights into financial topics, explore our other articles and resources.