Comprehensive Guide To Chase Home Improvement Loan Interest Rates

Home improvement loans have become an increasingly popular financial tool for homeowners looking to upgrade or renovate their properties. Whether you're planning a kitchen remodel, bathroom update, or energy-efficient upgrade, understanding Chase home improvement loan interest rates is crucial for making informed decisions. This article will delve into the nuances of these loans, offering expert advice, actionable tips, and essential insights to help you secure the best rates available.

Chase, one of the leading financial institutions in the United States, offers competitive home improvement loan options that cater to a wide range of homeowner needs. With the housing market evolving and property values on the rise, many homeowners are turning to these loans to enhance their living spaces while increasing their home's market value. However, navigating the complexities of interest rates and loan terms can be challenging without proper guidance.

In this article, we'll break down everything you need to know about Chase home improvement loan interest rates. From understanding how rates are determined to exploring strategies for securing lower rates, we'll equip you with the knowledge to make the most of your financing options. Let's dive in!

Read also:Filmy4webcom Your Ultimate Destination For Highquality Movies And Tv Shows

Table of Contents

- Understanding Chase Home Improvement Loans

- Factors Affecting Chase Home Improvement Loan Interest Rates

- Types of Chase Home Improvement Loans

- Eligibility Requirements for Chase Loans

- Current Chase Home Improvement Loan Interest Rates

- Tips for Securing Lower Chase Loan Interest Rates

- The Chase Loan Application Process

- Benefits of Choosing Chase Home Improvement Loans

- Common Questions About Chase Home Improvement Loans

- Conclusion

Understanding Chase Home Improvement Loans

Chase home improvement loans are designed to provide homeowners with the financial resources needed to enhance their properties. These loans are versatile, allowing borrowers to fund a variety of projects, from structural repairs to aesthetic upgrades. Understanding the mechanics of these loans is essential for anyone considering this financing option.

What Are Chase Home Improvement Loans?

Chase home improvement loans are personal loans specifically tailored for home-related projects. They offer fixed interest rates, predictable monthly payments, and a range of loan amounts to suit various project budgets. Unlike home equity loans, which are secured by your home's equity, Chase personal loans are unsecured, meaning they do not require collateral.

Why Choose Chase for Your Home Improvement Needs?

- Competitive interest rates

- Flexible repayment terms

- Quick approval process

- Excellent customer service

Factors Affecting Chase Home Improvement Loan Interest Rates

Several factors influence the interest rates you'll receive on a Chase home improvement loan. Understanding these factors can help you anticipate and potentially negotiate better rates.

Credit Score

Your credit score plays a significant role in determining your eligibility and the interest rate you'll be offered. Higher credit scores typically result in lower interest rates, as lenders perceive lower risk.

Loan Amount and Term

The amount you borrow and the length of the loan term also impact your interest rate. Larger loans or longer repayment periods may come with higher rates due to increased risk for the lender.

Types of Chase Home Improvement Loans

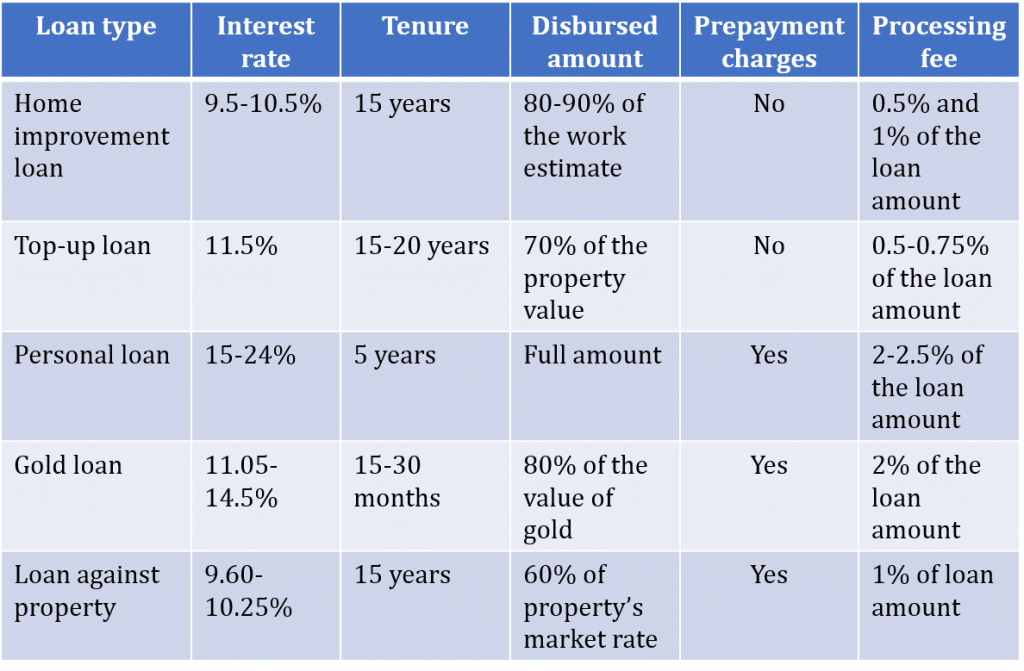

Chase offers multiple loan options to cater to different homeowner needs. Below are some of the most common types of home improvement loans:

Read also:Raspberry Pi Remoteiot Download For Mac A Comprehensive Guide

Personal Loans

Unsecured personal loans are ideal for smaller projects. They offer fixed interest rates and predictable monthly payments, making budgeting easier.

Home Equity Loans

For larger projects, home equity loans can provide access to significant funds at lower interest rates compared to personal loans. These loans are secured by your home's equity.

Home Equity Lines of Credit (HELOC)

A HELOC allows you to draw funds as needed, similar to a credit card. This option is perfect for ongoing or phased projects.

Eligibility Requirements for Chase Loans

To qualify for a Chase home improvement loan, you must meet certain eligibility criteria. These requirements ensure that borrowers are capable of repaying the loan responsibly.

Age and Citizenship

Borrowers must be at least 18 years old and either U.S. citizens or permanent residents.

Income Verification

Chase requires proof of income to assess your ability to repay the loan. This may include pay stubs, tax returns, or bank statements.

Current Chase Home Improvement Loan Interest Rates

As of the latest update, Chase home improvement loan interest rates range from 6.99% to 24.99%, depending on factors such as credit score, loan amount, and repayment term. It's important to note that these rates are subject to change based on market conditions and individual borrower profiles.

Fixed vs. Variable Rates

Chase offers both fixed and variable interest rate options. Fixed rates remain constant throughout the loan term, providing stability and predictability. Variable rates may fluctuate based on market conditions, potentially leading to savings or increased costs over time.

Tips for Securing Lower Chase Loan Interest Rates

While Chase determines interest rates based on various factors, there are steps you can take to improve your chances of securing lower rates:

- Improve your credit score by paying bills on time and reducing debt

- Opt for shorter repayment terms if feasible

- Borrow only what you need to minimize loan amounts

- Consider securing the loan with collateral, such as a home equity loan

The Chase Loan Application Process

Applying for a Chase home improvement loan is a straightforward process. Here's a step-by-step guide to help you navigate the application:

Step 1: Gather Required Documentation

Collect all necessary documents, including proof of income, identification, and property details.

Step 2: Complete the Application

Fill out the online application form, providing accurate and complete information to expedite the process.

Step 3: Review Loan Offers

Once approved, review the loan offers presented to you, considering interest rates, terms, and fees before making a decision.

Benefits of Choosing Chase Home Improvement Loans

Chase home improvement loans offer numerous advantages that make them an attractive option for homeowners:

Reputation and Trust

As one of the largest banks in the U.S., Chase is known for its reliability and customer service.

Versatile Loan Options

With a variety of loan types available, Chase can accommodate a wide range of home improvement needs.

Common Questions About Chase Home Improvement Loans

How Long Does It Take to Get Approved?

Chase typically processes applications within a few business days, with some cases receiving same-day approval.

Are There Any Hidden Fees?

Chase is transparent about its fees, which may include origination fees and prepayment penalties. Always review the loan agreement carefully.

Conclusion

In summary, Chase home improvement loans provide a reliable and flexible financing solution for homeowners looking to enhance their properties. By understanding the factors affecting interest rates, exploring available loan options, and following tips for securing lower rates, you can make the most of your investment.

We encourage you to take action by applying for a Chase home improvement loan today. Share your thoughts or ask questions in the comments below, and don't forget to explore other informative articles on our website for more financial insights.