Maximizing Your Financial Opportunities: A Comprehensive Guide To Chase Personal Lines Of Credit

In today's rapidly evolving financial landscape, access to credit is more crucial than ever. Chase personal lines of credit offer a flexible solution for managing expenses, consolidating debt, or funding unexpected costs. Understanding how this financial tool works can empower you to make informed decisions about your financial future. Whether you're planning a home renovation, covering medical expenses, or simply need extra cash flow, a personal line of credit from Chase can provide the flexibility you need.

However, before diving into the world of personal lines of credit, it's important to understand the nuances of this financial product. Unlike traditional loans, a line of credit allows you to borrow up to a pre-approved limit as needed, paying interest only on the amount you use. This feature makes it an attractive option for those seeking financial flexibility without the burden of fixed payments.

In this comprehensive guide, we will explore everything you need to know about Chase personal lines of credit. From eligibility requirements and interest rates to application tips and management strategies, this article will equip you with the knowledge to make the most of this financial tool. Let's dive in and uncover the potential benefits of a Chase personal line of credit.

Read also:Girthmaster Vs Mia Z A Comprehensive Comparison

Table of Contents

- What is a Chase Personal Line of Credit?

- Eligibility Requirements for Chase Personal Lines of Credit

- Interest Rates and Fees

- Application Process

- Benefits of Chase Personal Lines of Credit

- Uses for a Personal Line of Credit

- Managing Your Chase Personal Line of Credit

- Common Mistakes to Avoid

- Comparison with Other Credit Options

- Frequently Asked Questions

What is a Chase Personal Line of Credit?

A Chase personal line of credit is a flexible borrowing tool that allows you to access a pre-approved amount of money whenever you need it. Unlike a traditional loan, which provides a lump sum of money upfront, a personal line of credit gives you the freedom to draw funds as needed, up to your credit limit. This means you only pay interest on the amount you borrow, making it a cost-effective solution for managing expenses.

Key Features of Chase Personal Lines of Credit

Here are some of the key features that make Chase personal lines of credit a popular choice among consumers:

- Revolving Credit: You can borrow, repay, and borrow again within your credit limit.

- Variable Interest Rates: The interest rate on your line of credit may fluctuate based on market conditions.

- Flexible Repayment Terms: You have the option to make interest-only payments or pay down the principal.

- Convenience: Access your funds easily through checks, online transfers, or in-person withdrawals.

Understanding these features can help you determine whether a Chase personal line of credit is the right financial tool for your needs.

Eligibility Requirements for Chase Personal Lines of Credit

To qualify for a Chase personal line of credit, you must meet certain eligibility criteria. These requirements are designed to ensure that borrowers are financially responsible and capable of repaying their debts. Below are some of the key factors Chase considers when evaluating your application:

Factors That Influence Eligibility

- Credit Score: A good or excellent credit score (typically 670 or higher) increases your chances of approval.

- Income: Demonstrating a stable income is crucial for qualifying for a line of credit.

- Debt-to-Income Ratio: Lenders prefer applicants with a low debt-to-income ratio, indicating a manageable level of existing debt.

- Employment History: A stable employment history can strengthen your application.

Meeting these requirements can improve your likelihood of being approved for a Chase personal line of credit.

Interest Rates and Fees

One of the most important considerations when applying for a Chase personal line of credit is understanding the associated interest rates and fees. These costs can significantly impact the overall affordability of the credit line. Here's what you need to know:

Read also:Does Barron Trump Sing And Play Guitar Exploring The Musical Talent Of Barron Trump

Understanding Interest Rates

Chase personal lines of credit typically come with variable interest rates, which means the rate can change over time based on market conditions. The interest rate you receive will depend on factors such as your credit score, income, and overall financial profile.

Potential Fees

- Origination Fee: Some lines of credit may charge an origination fee, although Chase often waives this for eligible applicants.

- Annual Fee: Depending on the product, there may be an annual fee for maintaining the line of credit.

- Late Payment Fee: Failing to make timely payments can result in late fees and negatively impact your credit score.

Being aware of these costs can help you budget effectively and avoid unexpected expenses.

Application Process

Applying for a Chase personal line of credit is a straightforward process, but it's important to prepare adequately to increase your chances of approval. Here's a step-by-step guide to help you navigate the application process:

Step 1: Gather Required Documents

Before applying, make sure you have the following documents ready:

- Proof of income (e.g., pay stubs, tax returns)

- Identification (e.g., driver's license, passport)

- Bank statements

Step 2: Complete the Application

You can apply for a Chase personal line of credit online or in person at a Chase branch. The application process typically takes just a few minutes, and you'll receive a decision quickly.

By following these steps, you can ensure a smooth and efficient application process.

Benefits of Chase Personal Lines of Credit

A Chase personal line of credit offers numerous benefits that make it a valuable financial tool. Here are some of the key advantages:

Flexibility

With a personal line of credit, you have the flexibility to borrow as much or as little as you need, up to your credit limit. This makes it an ideal solution for managing fluctuating expenses.

Cost-Effectiveness

Since you only pay interest on the amount you borrow, a Chase personal line of credit can be more cost-effective than traditional loans, which require interest payments on the entire loan amount regardless of usage.

Convenience

Accessing your funds is easy with Chase personal lines of credit. You can withdraw money through checks, online transfers, or in-person withdrawals at a Chase branch.

These benefits make Chase personal lines of credit a versatile option for a wide range of financial needs.

Uses for a Personal Line of Credit

A Chase personal line of credit can be used for a variety of purposes, depending on your financial needs. Here are some common uses:

Home Improvements

Whether you're renovating your kitchen or updating your bathroom, a personal line of credit can provide the funds you need to complete your home improvement projects.

Debt Consolidation

If you're juggling multiple high-interest debts, a Chase personal line of credit can help you consolidate your debts into a single, more manageable payment.

Medical Expenses

Unexpected medical bills can be a significant financial burden. A personal line of credit can help you cover these costs without depleting your savings.

These are just a few examples of how a Chase personal line of credit can be used to address various financial needs.

Managing Your Chase Personal Line of Credit

Successfully managing your Chase personal line of credit requires careful planning and responsible financial habits. Here are some tips to help you make the most of this financial tool:

Set a Budget

Create a budget that includes your line of credit payments to ensure you stay on track with repayments.

Make Timely Payments

Paying your bills on time not only avoids late fees but also helps you maintain a good credit score.

Monitor Your Balance

Regularly check your balance to ensure you're not exceeding your credit limit and to track your progress in paying down your debt.

By following these tips, you can effectively manage your Chase personal line of credit and avoid potential pitfalls.

Common Mistakes to Avoid

While Chase personal lines of credit offer numerous benefits, there are some common mistakes that can lead to financial difficulties. Here are a few pitfalls to avoid:

Borrowing More Than You Need

Tempted to borrow the maximum amount available? Resist the urge and only borrow what you truly need to avoid unnecessary debt.

Ignoring Repayment Terms

Failing to understand the repayment terms can lead to missed payments and financial strain. Make sure you're fully aware of your obligations before borrowing.

Using the Line of Credit for Non-Essential Expenses

Reserve your Chase personal line of credit for important expenses rather than discretionary purchases to maintain financial stability.

Avoiding these mistakes can help you use your Chase personal line of credit responsibly and effectively.

Comparison with Other Credit Options

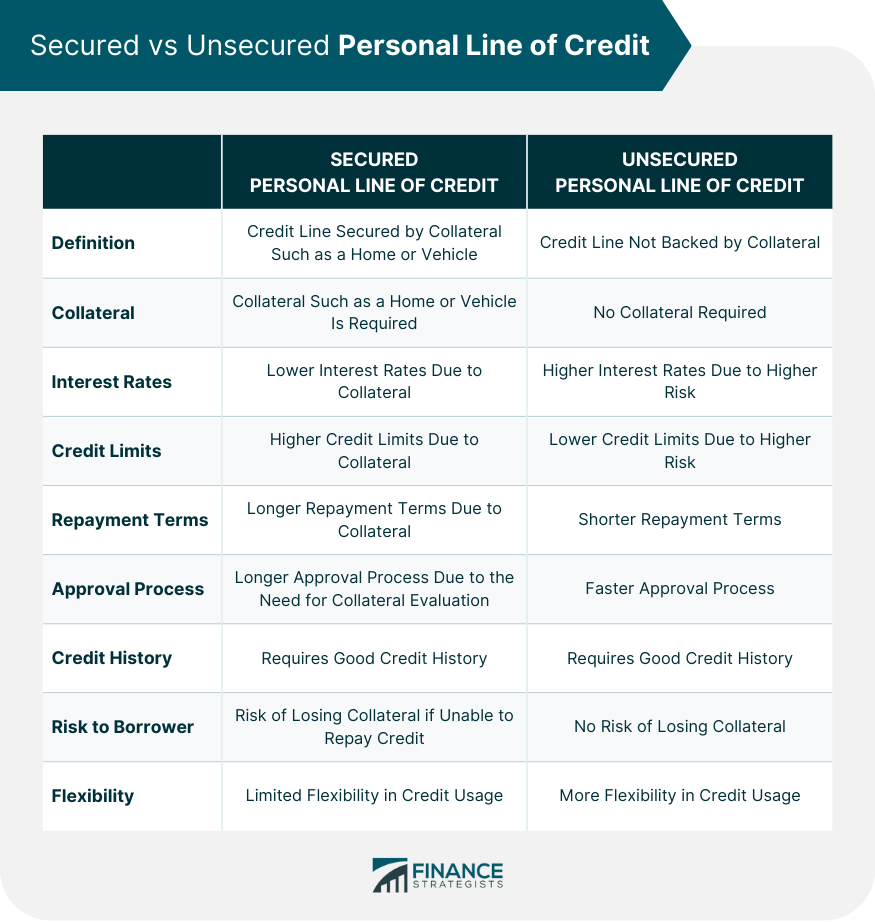

When considering a Chase personal line of credit, it's important to compare it with other credit options to determine which is best for your needs. Here's how Chase personal lines of credit stack up against other borrowing tools:

Credit Cards

While both credit cards and personal lines of credit offer revolving credit, lines of credit typically come with lower interest rates and higher credit limits.

Personal Loans

Unlike personal loans, which provide a lump sum of money with fixed payments, personal lines of credit offer more flexibility, allowing you to borrow as needed.

Home Equity Lines of Credit (HELOCs)

HELOCs are similar to personal lines of credit but are secured by your home, potentially offering lower interest rates but with the risk of losing your property if you default.

Understanding these differences can help you choose the credit option that best suits your financial situation.

Frequently Asked Questions

Can I Use My Chase Personal Line of Credit for Anything?

Yes, you can use your Chase personal line of credit for a wide range of purposes, including home improvements, debt consolidation, and medical expenses. However, it's important to use the funds responsibly and avoid unnecessary debt.

What Happens If I Miss a Payment?

Missing a payment can result in late fees and negatively impact your credit score. It's crucial to make timely payments to avoid these consequences.

Is There a Penalty for Paying Off My Line of Credit Early?

No, there is no penalty for paying off your Chase personal line of credit early. In fact, paying off your balance early can save you money on interest and improve your credit score.

These frequently asked questions address common concerns about Chase personal lines of credit and provide clarity on key aspects of this financial tool.

Kesimpulan

In conclusion, Chase personal lines of credit offer a flexible and cost-effective solution for managing a variety of financial needs. By understanding the eligibility requirements, interest rates, and application process, you can make an informed decision about whether this financial tool is right for you.

We encourage you to take action by exploring your options and applying for a Chase personal line of credit if it aligns with your financial goals. Don't forget to share this article with others who may benefit from the information, and feel free to leave a comment with any questions or feedback. Together, let's build a more financially secure future.