What Is AFLAC? A Comprehensive Guide To Understanding This Leading Insurance Provider

When it comes to insurance, AFLAC is a name that stands out in the market. As one of the largest providers of supplemental insurance in the United States, AFLAC offers a wide range of products designed to protect individuals and families from unexpected expenses. Whether you're looking to secure your financial future or safeguard your loved ones, understanding what AFLAC offers is essential. In this article, we'll explore everything you need to know about AFLAC, its history, services, and why it matters to you.

AFLAC, which stands for American Family Life Assurance Company, has been a trusted name in the insurance industry for decades. Its innovative approach to supplemental insurance has made it a go-to choice for millions of Americans seeking extra financial protection. With its unique business model and commitment to customer satisfaction, AFLAC continues to thrive in a competitive market.

In today's uncertain world, having the right insurance coverage is more important than ever. Whether you're dealing with medical expenses, lost income, or other unexpected costs, AFLAC provides solutions tailored to meet your needs. This article will delve into the company's offerings, history, and why it remains a leader in the insurance sector.

Read also:Richard Dadario The Visionary Entrepreneur Shaping The Modern Business Landscape

Table of Contents

- The History of AFLAC

- AFLAC's Insurance Products

- Understanding AFLAC's Business Model

- AFLAC's Market Position

- AFLAC's Commitment to Customer Service

- Financial Strength and Ratings

- AFLAC's International Presence

- Why Choose AFLAC?

- Common Questions About AFLAC

- Conclusion and Call to Action

The History of AFLAC

Founded in 1955, AFLAC began as a small insurance company with a big vision. The company was established by five brothers—John Amos, Paul Amos II, William Amos, Louis Amos, and Ernest Amos—who aimed to provide affordable supplemental insurance to working Americans. What started as a regional operation quickly grew into a national powerhouse.

In 1970, AFLAC introduced its now-iconic duck mascot, which became synonymous with the company's brand. The duck, known for its catchy slogan "AFLAC," helped raise awareness about the company's offerings and solidified its presence in popular culture. Today, AFLAC operates in both the United States and Japan, serving millions of customers worldwide.

Key Milestones in AFLAC's History

- 1955: Founding of American Family Life Assurance Company.

- 1970: Introduction of the AFLAC duck mascot.

- 1988: Expansion into Japan, marking the beginning of AFLAC's international presence.

- 2000s: Continued growth and recognition as a leader in supplemental insurance.

AFLAC's Insurance Products

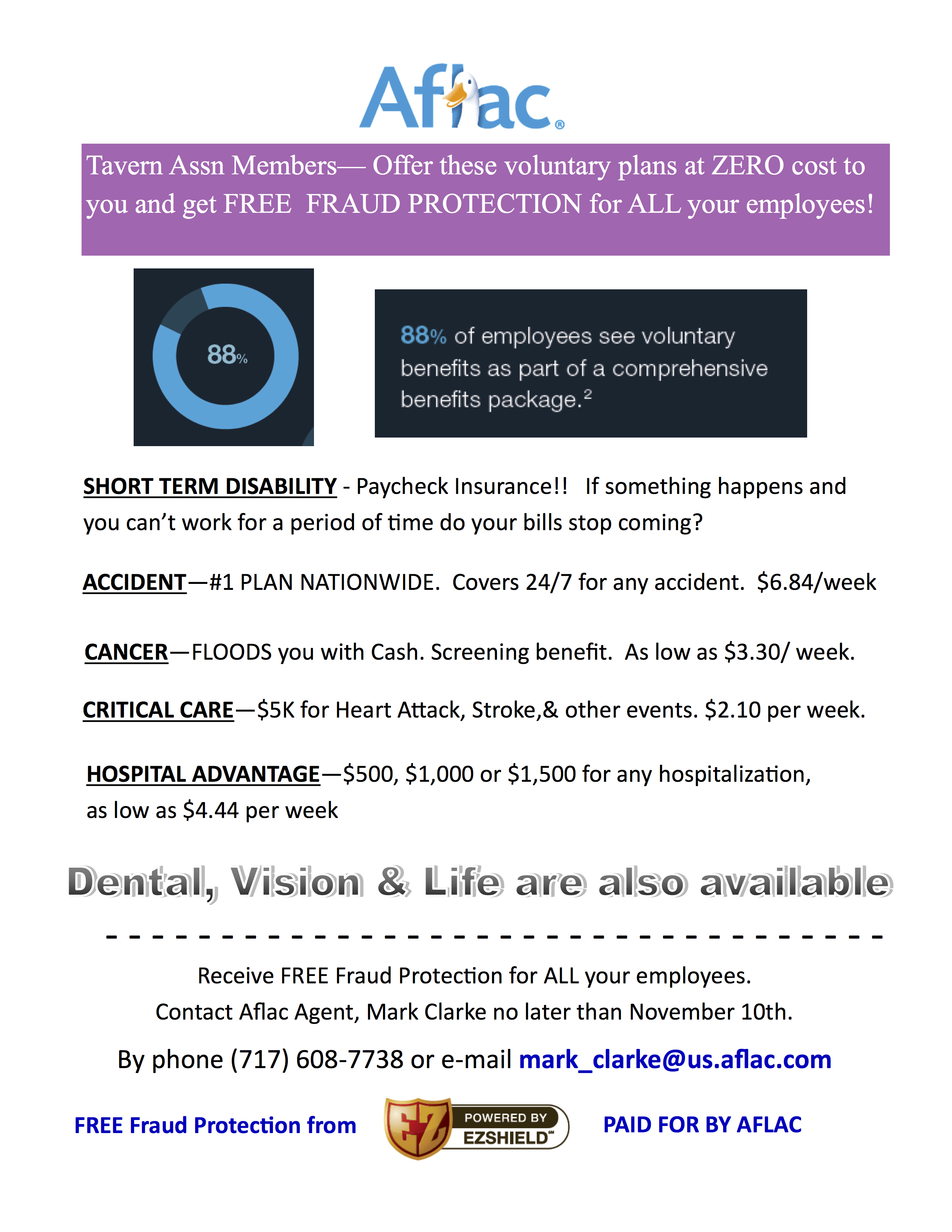

AFLAC offers a diverse range of insurance products designed to meet the needs of individuals, families, and businesses. Its primary focus is on supplemental insurance, which provides additional financial protection beyond traditional health insurance plans. Here's a closer look at some of the key products offered by AFLAC:

1. Critical Illness Insurance

Critical illness insurance from AFLAC provides a lump-sum payment if you're diagnosed with a covered condition, such as cancer, heart attack, or stroke. This money can be used to cover medical expenses, pay bills, or take time off work.

2. Accident Insurance

Accident insurance helps cover the costs associated with unexpected injuries. Whether you're dealing with hospital bills, rehabilitation, or lost wages, AFLAC's accident insurance can provide financial relief.

3. Hospital Insurance

Hospital insurance offers protection against the high costs of hospital stays. With this coverage, you'll receive a cash benefit for each day you're hospitalized, helping you manage expenses during your recovery.

Read also:How To Remotely Access Raspberry Pi For Remote Iot Projects Free Guide

Understanding AFLAC's Business Model

AFLAC's business model is built on providing affordable, accessible insurance solutions to individuals and families. Unlike traditional health insurance providers, AFLAC focuses on supplemental coverage, which complements existing plans rather than replacing them. This approach allows customers to tailor their coverage to their specific needs and budget.

One of the key factors behind AFLAC's success is its direct-to-employer sales strategy. By partnering with employers, AFLAC makes it easy for employees to enroll in coverage through payroll deductions. This streamlined process increases accessibility and convenience for policyholders.

Advantages of AFLAC's Business Model

- Focus on supplemental insurance for comprehensive protection.

- Direct-to-employer sales strategy for ease of enrollment.

- Customizable coverage options to meet individual needs.

AFLAC's Market Position

AFLAC is a dominant player in the supplemental insurance market, with a strong presence in both the United States and Japan. In the U.S., AFLAC serves over 50 million customers and is the leading provider of worksite insurance products. In Japan, AFLAC holds a significant market share and is one of the largest life insurance companies in the country.

The company's success can be attributed to its innovative approach, strong brand recognition, and commitment to customer satisfaction. By continuously adapting to changing market conditions and consumer needs, AFLAC has maintained its leadership position in the insurance industry.

Global Reach and Influence

- Leader in supplemental insurance in the United States.

- Significant market share in Japan's life insurance sector.

- Global presence with operations in multiple countries.

AFLAC's Commitment to Customer Service

At AFLAC, customer satisfaction is a top priority. The company prides itself on delivering exceptional service through its dedicated team of representatives and streamlined claims process. Whether you're enrolling in coverage, filing a claim, or seeking assistance, AFLAC is committed to making the experience as smooth and stress-free as possible.

One of the standout features of AFLAC's customer service is its rapid claims processing. On average, claims are paid within two business days, ensuring that customers receive the financial support they need quickly and efficiently. This commitment to speed and accuracy has earned AFLAC a reputation for reliability and trustworthiness.

Key Features of AFLAC's Customer Service

- Rapid claims processing with payments in two business days.

- Dedicated customer service representatives available to assist.

- Online tools and resources for easy access to information.

Financial Strength and Ratings

AFLAC's financial strength is a testament to its stability and reliability as an insurance provider. The company consistently receives high ratings from leading industry organizations, including Standard & Poor's and Moody's. These ratings reflect AFLAC's strong capital position, robust risk management practices, and commitment to fulfilling its obligations to policyholders.

In addition to its financial strength, AFLAC has demonstrated resilience during economic downturns, maintaining profitability and stability even in challenging market conditions. This track record of success reinforces its position as a trusted partner for individuals and businesses seeking supplemental insurance coverage.

AFLAC's Financial Ratings

- Standard & Poor's: A+ (Strong)

- Moody's: A1 (Good)

- A.M. Best: A (Excellent)

AFLAC's International Presence

While AFLAC is well-known in the United States, its international operations have significantly contributed to its global success. In Japan, AFLAC operates as one of the largest life insurance companies, offering a wide range of products tailored to the Japanese market. The company's ability to adapt its offerings to meet local needs has been a key factor in its international expansion.

Beyond Japan, AFLAC has explored opportunities in other countries, leveraging its expertise in supplemental insurance to address the unique challenges faced by global consumers. This global perspective ensures that AFLAC remains at the forefront of innovation in the insurance industry.

Global Expansion Strategies

- Tailored products for international markets.

- Partnerships with local businesses and organizations.

- Focus on customer-centric solutions worldwide.

Why Choose AFLAC?

Choosing AFLAC as your supplemental insurance provider offers numerous benefits. From its comprehensive product offerings to its commitment to customer service, AFLAC stands out as a reliable partner for protecting your financial future. Here are some reasons why AFLAC is the right choice for many individuals and families:

Reasons to Choose AFLAC

- Wide range of supplemental insurance products.

- Strong financial stability and ratings.

- Fast claims processing and excellent customer service.

Common Questions About AFLAC

Many people have questions about AFLAC and its offerings. Below are some of the most frequently asked questions and their answers:

1. What does AFLAC stand for?

AFLAC stands for American Family Life Assurance Company.

2. Is AFLAC only available in the United States?

No, AFLAC also operates in Japan and has explored opportunities in other countries.

3. How long has AFLAC been in business?

AFLAC was founded in 1955, making it over 65 years old.

Conclusion and Call to Action

In conclusion, AFLAC is a trusted leader in the supplemental insurance industry, offering innovative solutions to help individuals and families protect their financial futures. With its wide range of products, strong financial stability, and commitment to customer service, AFLAC continues to be a top choice for millions of customers worldwide.

We invite you to take the next step in securing your financial well-being by exploring AFLAC's offerings further. Leave a comment below with any questions or insights, share this article with others who may benefit from it, and consider reading more about AFLAC's products and services on their official website. Together, we can build a brighter, more secure future.